Big score for Tirupati as court orders KCB Bank to provide crucial loan documents

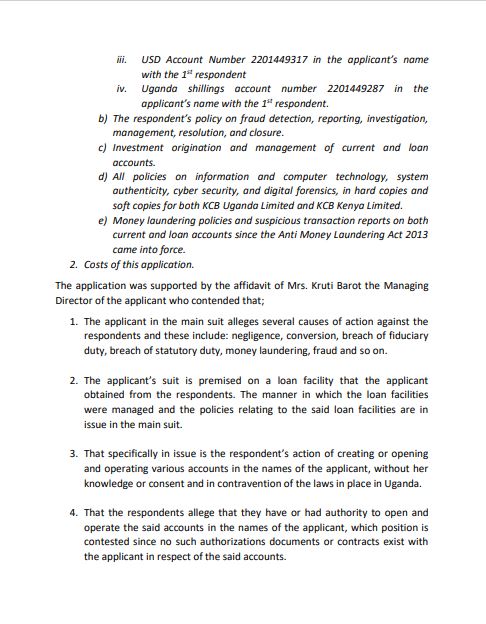

The documents sought by the applicant include those related to the loan transaction and loan account origination, negotiation, approval, processing, key facts documents, management, and closure.

An attempt by KCB Bank, as respondents, to withhold key materials in a case against Tirupati Development Limited, as applicants, has hit a snag after Justice Musa Sekaana of the high court (civil division) of Kampala on 5th May 2023 ruled in favor of the application.

The High Court has since issued a ruling granting an order for the discovery of documents as prayed for in the application by Tirupati supported by the affidavit of Mrs. Kruti Barot the Managing Director of the applicant.

The documents sought by the applicant include those related to the loan transaction and loan account origination, negotiation, approval, processing, key facts documents, management, and closure.

Specifically, the applicant requested documents pertaining to the loan accounts, various bank accounts in the applicant’s name, fraud detection policies, investment origination and management, IT policies, cyber security, digital forensics, and money laundering policies since the enactment of the Anti Money Laundering Act in 2013.

Mrs. Barot highlighted several causes of action alleged by the applicant against the respondents, including negligence, conversion, breach of fiduciary duty, breach of statutory duty, money laundering, and fraud.

She emphasized the importance of the requested documents in determining the respondents’ authority to open and operate accounts in the applicant’s name and the legitimacy of the various transactions.

The respondents opposed the application through an affidavit filed by Judy Wambaire, the company secretary of KCB Bank (U) Ltd. They argued that the application lacked specificity, with broad and ambiguous terms making it difficult to ascertain the relevant documents in their possession.

The respondents also raised concerns about breaching privacy rights, confidentiality agreements, and potential harm to their internal processes and customers if the documents were disclosed.

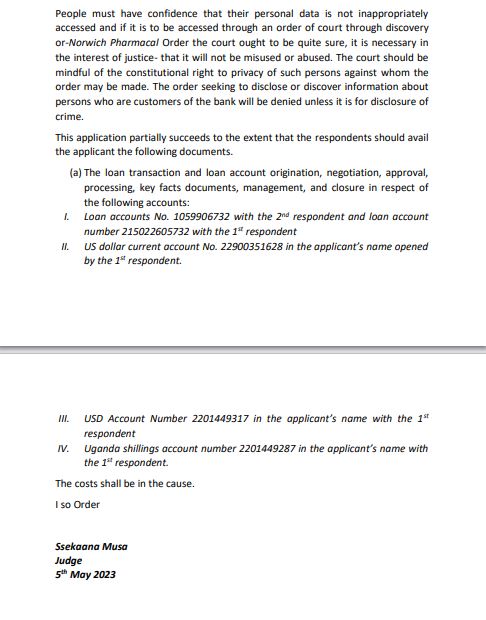

But after considering the submissions from both parties, Justice Ssekaana ruled in favor of the applicant. “This application partially succeeds to the extent that the respondents should avail the applicant the following documents,” Justice Ssekaana wrote in the ruling.

He lists the documents as the following.

(a) The loan transaction and loan account origination, negotiation, approval, processing, key facts documents, management, and closure in respect of the following accounts:

- Loan accounts No. 1059906732 with the 2nd respondent and loan account number 215022605732 with the 1st respondent

- US dollar current account No. 22900351628 in the applicant’s name opened by the 1st respondent.

III. USD Account Number 2201449317 in the applicant’s name with the 1st respondent

- Uganda shillings account number 2201449287 in the applicant’s name with the 1st respondent.

The costs shall be in the cause, he concluded.