Finance

-

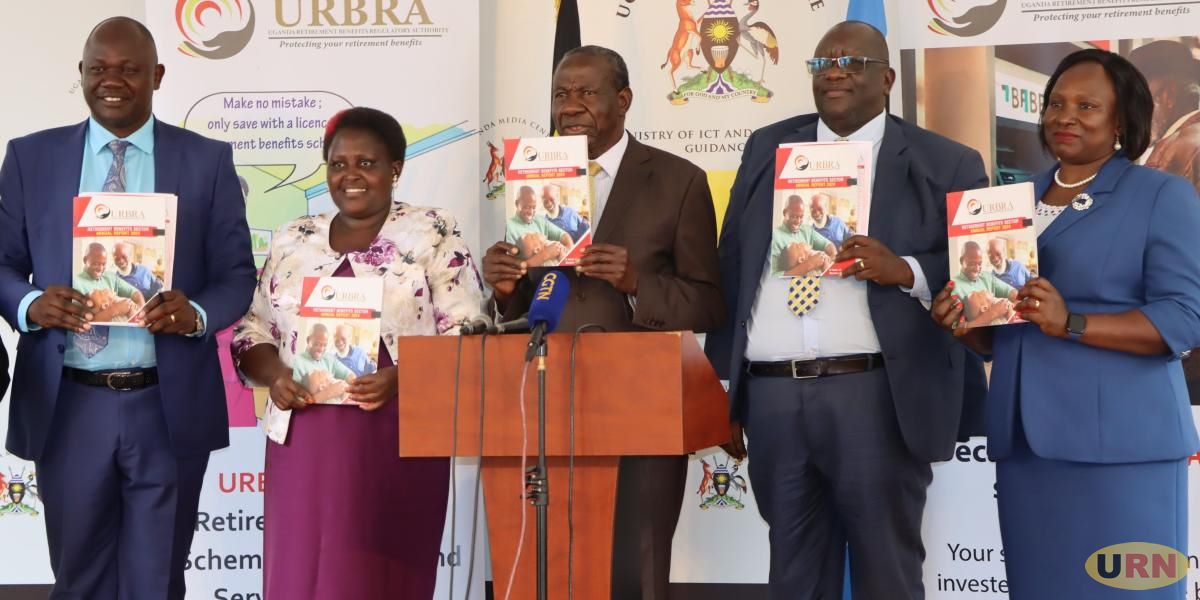

How Uganda’s retirement benefits sector hit UGX 25.4 trillion, boosting GDP to 12.2%

Uganda’s retirement benefits sector has achieved remarkable growth, with its total value rising to UGX 25.40 trillion in 2024 an…

-

Businessman’s loan saga exposes Uganda’s credit challenges

A Ugandan businessman’s struggle to secure a fair loan valuation has shed light on the barriers to accessing affordable credit…

-

Museveni orders probe into UGX60 billion bank of Uganda heist

President Yoweri Museveni has directed an investigation into the theft of UGX 60 billion (about $16 million) from the Bank…

-

What the new interest rate cap means for Ugandans

The government’s decision to cap annual interest rates at 33.6% for money lenders and Tier 4 microfinance institutions is set…

-

No tax on employee food allowances, URA clarifies

The Uganda Revenue Authority (URA) has dismissed rumors that it’s planning to slap a tax on employee food allowances, calling…

-

Why Ugandans still struggle to access loans despite central bank rate cut

The Bank of Uganda’s recent move to cut its central bank rate to 9.75% was meant to signal a lifeline…

-

MPs question Finance Ministry over excess budget releases to districts

The Public Accounts Committee (Local Government) has raised concerns about the Ministry of Finance’s release of excess funds to districts,…

-

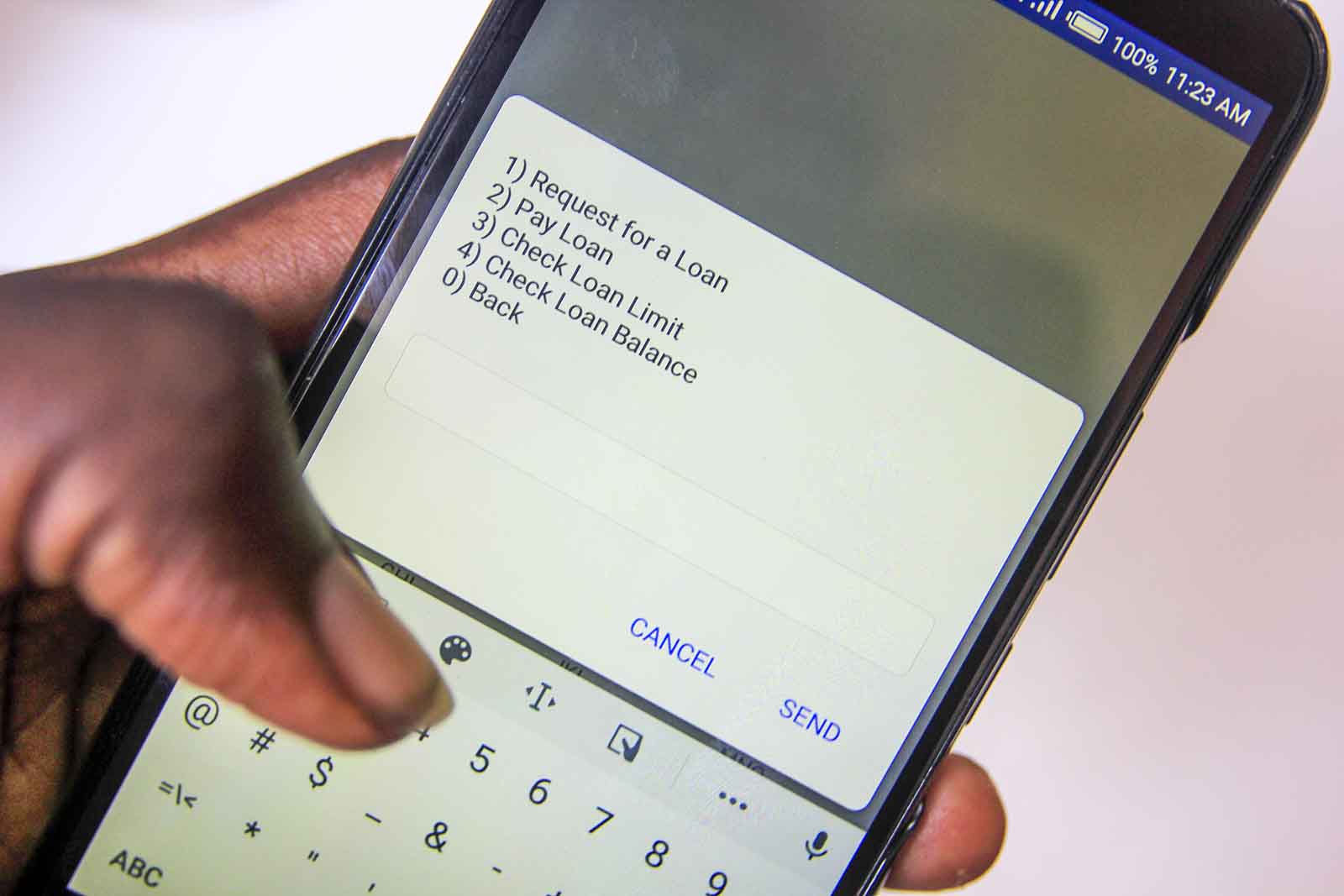

Time’s up for mobile money loan defaulters, telecoms tighten the noose

The world of digital lending is about to get tougher for loan defaulters in Uganda, as telecom companies prepare to…

-

BOU lowers interest rate to 9.75% as inflation eases

On October 7, 2024, the Bank of Uganda’s Monetary Policy Committee (MPC) lowered the Central Bank Rate (CBR) by 25…

-

NSSF unveils initiative to attract informal sector workers

In an effort to improve Uganda’s savings culture and enhance economic security for informal sector workers, the National Social Security…