Gov’t to spend up to Shs24.9 trillion on servicing Uganda’s public debt

The Ministry of Finance has revealed that the Government will spend up to Shs24.9 trillion on servicing Uganda’s public debt.

This comes months after the Bank of Uganda reported that Uganda’s public debt as of August 2023 stood at Shs 88.807 trillion. The August debt figures do not include the Shs7 trillion worth of loans Parliament approved in December.

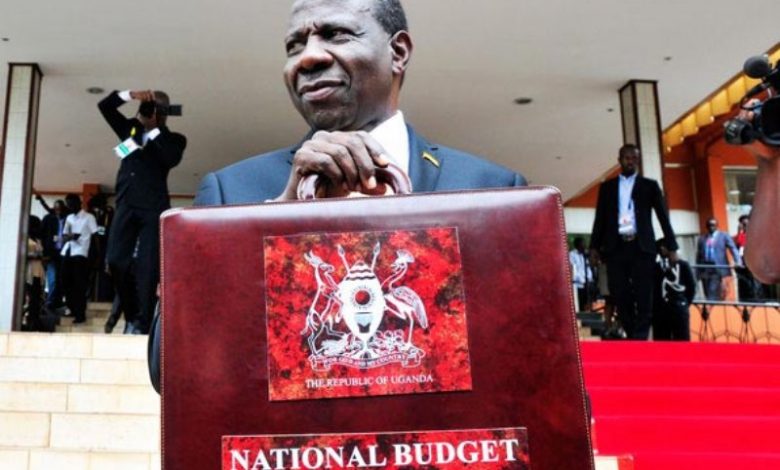

While appearing before Parliament’s Finance Committee to present the 2024/25 National Budget Framework Paper, Stephen Ojiambo, Commissioner of Accounts in the Treasury Operations, said that in the coming financial year, the Ministry of Finance will focus on payment of each debt as when it falls due so as not to attract interest from the lenders.

According to the Ministry of Finance, the projection for expenditure on external amortisation has increased because of huge principal repayments of Shs950 billion on the Karuma power dam project, Shs190 billion on the Isimba dam, Shs108 billion on Kabalega International Airport, Shs218 billion on Afrexim Budget support, SHS 241 billion on Standard Bank and Shs365 billion on TDB budget support.

The latest development comes at the time the Bank of Uganda, in its quarterly State of Economy report for December 2023, expressed concern over the increasing public debt.

According to BOU this is exerting pressure on revenue collections with the report stating, “Interest payments and external debt principal repayments exert elevated pressure on tax revenues to the extent that for every Shs100 collected in tax revenues, Shs32 goes to debt service, diminishing resources available for service delivery.”

The Ministry of Finance also revealed plans to inject Shs197 billion into Roko Construction Company and Lubowa Specialized Hospital.

Officials said this would be part of the Government’s obligation to purchase shares in Roko Construction Company and payment of four promissory notes for Lubowa Specialised Hospital. The obligations to the construction firm and Italian Enrica Penetti’s Lubowa Specialised Hospital are projected to mature during the 2024/25 financial year.

DRC Debt

Next financial year, the Government has also budgeted for Shs274 billion as part payment of the reparations to the Democratic Republic of Congo for the resources that were plundered when the Ugandan troops operated in the neighbouring country in the late 1990s.

A 2001 UN report found Uganda’s Army guilty of looting minerals, coffee, timber and livestock during an earlier deployment. In February 2022, the International Court of Justice (ICJ) ordered Uganda to pay DRC $325m (about SHS1.234 trillion).

Effects of Anti Gay Law

During the meeting, Henry Musasizi, Minister of State for Finance (General Duties), revealed that the enactment of the Anti-Homosexuality Act has created external financial risks and uncertainty for Uganda, thus prompting the government to intensify negotiations with the World Bank to lift the ban on lending to new projects in Uganda.

“The enactment of the anti-homosexuality Act has created external financing risks and uncertainty. We have continued with our engagements with the World Bank to ensure the lifting of the ban on the financing of the new projects,” said Musasizi.

He said that Uganda’s economic situation is further challenged by the lagged effects of COVID-19 on economic growth and, consequently, revenue mobilisation. The sharp increase in interest rates globally has increased the cost of external borrowing.

Bank of Uganda also, in its December 2023 State of Economy Performance Report, revealed that the pronouncement by the World Bank to halt funding projects in Uganda following the passing of the Anti-Homosexuality Act saw the Uganda Shilling depreciate in value against the dollar date.