Korean investors eye Africa untapped potential

The business forum was held at the 7th Korea-Africa Economic Cooperation Ministerial Conference, held in Korea's second-largest city, Busan.

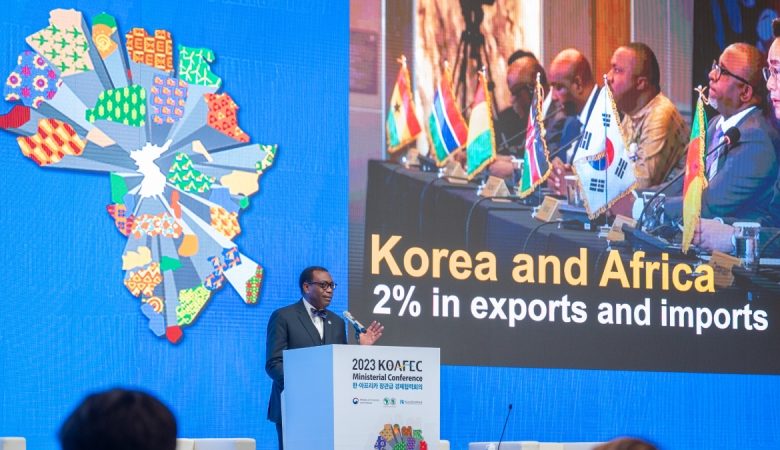

African Development Bank President Akinwumi Adesina has called on Korean investors to seize untapped investment opportunities in Africa, especially in the energy and agriculture sectors.

“Africa is a continent that cannot be ignored by investors,” Adesina said at a business forum attended by CEOs of Korean corporations, heads of financial institutions as well as ministers and business leaders from Africa.

The business forum was held at the 7th Korea-Africa Economic Cooperation Ministerial Conference, held in Korea’s second-largest city, Busan.

Adesina highlighted the potential for Africa to become a leading market frontier, boasting enormous potential in agriculture and renewable energy sources.

The bank chief assured Korean investors, “Africa is not as risky as you hear. It is a continent of opportunities, waiting to be tapped.” He cited Moody’s analysis of global infrastructure default rates which shows that the continent rank better at 5.5%, compared with 8.5% in Asia and 13% in Latin America.

The African Development Bank uses partial risk and credit guarantees to reduce the risks faced by the private sector.

Adesina observed that bilateral trade between Korea and Africa was important and growing, but said its volume needed to be improved. He said Korea’s trade with Africa in terms of exports and imports stood at only 2% of its total trade with the world. This, he said, must change given the huge economic opportunities and investment potential in Africa.

Adesina said: “The size of consumer expenditures is estimated to be $2.5 trillion by 2030. The African Continental Free Trade Area (AfCFTA), which is the largest in the world in terms of numbers of countries, is estimated at $3.5 trillion market size. With a population of 1.3 billion, of which 600 m are young people, rapid urbanisation and rising incomes of the middle class, Africa is the leading emerging market frontier.”

Adesina listed several sectors that he said offered huge opportunities, including energy and agriculture, which is expected to grow to $1 trillion by 2030. This includes the development of special agro-industrial processing zones in which the bank and partners have invested more than $1.5 billion in 11 countries.

In the energy sector, Adesina said Africa has enormous renewable energy potential, including 11 TW of solar, which is the highest in the world, but only one percent is utilised. With 350 GW of hydro, only 7% is utilised; 115 GW of wind potential of which only 2% is used; and 15 GW of geothermal power of which only 2% is utilised.

Speaking at the forum, Korea’s 1st Vice President, Minister of Economy and Finance, Byoung Hwan Kim, acknowledged that despite global shocks, African countries were experiencing higher growth rates.

Kim shared his strong conviction that there are enormous opportunities for investment in Africa compared to other continents and highlighted the important role of the private sector in harnessing these opportunities. Kim recalled that Korea was one of the poorest countries in the world but was able to overcome this largely by focusing on its small businesses and the private sector.

“We hope to share those experiences with our African counterparts,” he said, adding, “We support the private sector to boost investment and provide guarantees tailored to private sector needs.”

Kim said that the Korean government would work with the African Development Bank to identify opportunities and use the KOAFEC Trust Fund to enhance the capacity of the private sector.

The meeting identified the African Continental Free Trade Area as a platform for mutual trade and investment.

The Chairman and President of the Export-Import Bank of Korea, Hee-sung Yoon, said Africa’s population and vast resources offered enormous opportunities for growth. “The AfCFTA will connect Africa with the rest of the world,” Yoon said. “It will be an opportunity for Korea to build strategic partnerships,” he added.

The forum also heard how Africa offers strong investment opportunities in green metals that could drive global market growth in clean renewable energy technologies, where countries can create jobs, stimulate economic growth, and reduce their dependence on fossil fuels.

Adesina said Africa is the perfect place to build batteries for electric cars and lithium-ion batteries.

He invited Korean investors to its 2023 Africa Investment Forum (www.AfricaInvestmentForum.com/) in Marrakech, Morocco, from 10 to 12 November. The Africa Investment Forum has attracted $142 billion in investment interest in Africa over the past four years, including in energy, agribusiness, roads and transport, health, and digital technology.

During a subsequent panel session on Just Energy Transition in Africa, the CEO of Neo Themis, Tas Anvaripour encouraged Korean investors to consider on investing instead of only selling equipment. She assured the gathering that the African Development Bank was a trusted risk guarantor on the continent.

“In several of our business ventures in some African countries, the African Development Bank was there to support us. Its credit guarantee helped us reassure our foreign investors and acted as an honest broker when it mattered most. Institutions like this make investing in Africa easy,” Anvaripour said.