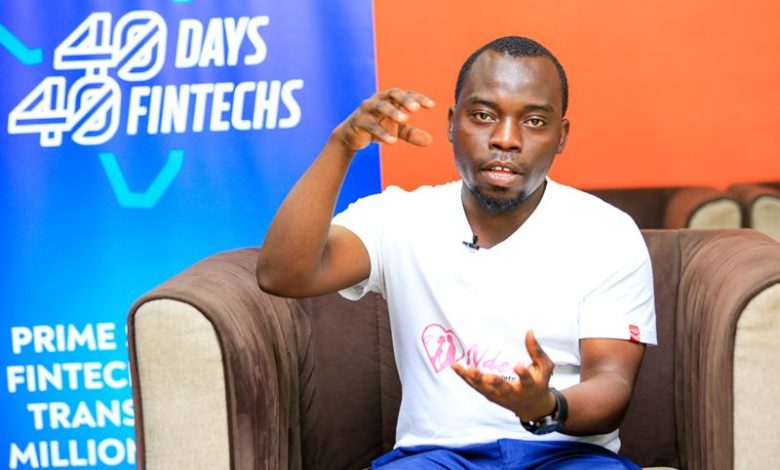

Remmo Is Using FinTech To Digitize Wedding Contributions And Fundraising Causes

However, besides the hardship of attending physical meetings, stories are told of treasurers who have misappropriated these contributions and eventually the weddings turn from celebrations to disappointments.

In African culture, whenever a young man is going to marry his bride, it is taken as a collective responsibility of the community to make contributions toward the success of the celebrations. This is always done through wedding meetings where people converge and manually collect money, while others make pledges and fulfill them at the next meeting.

However, besides the hardship of attending physical meetings, stories are told of treasurers who have misappropriated these contributions and eventually the weddings turn from celebrations to disappointments.

In 2020, a group of tech enthusiasts in Tanzania decided to prevent these scenarios by introducing a mobile platform where people can automatically make pledges and contributions without attending a physical meeting or paying cash.

Named the Remmo App, someone (it may be the bride or groom or any of their trusted representatives) just goes to this platform and creates a pledge account. Then they are required to fill in some data, such as the type of ceremony they want to conduct (it may be a wedding, send-off, birthday party, etc) and then they receive a unique identity.

“When someone registers, they get a link which they can share on other platforms like WhatsApp. When the friends tap the link, they go to the pledges page and contribute to that cause. Those that pledge can pay in installments until they fulfill the pledge,” says Buliba Fadhili Magambo, the CEO Nderemo Company Ltd, the organization that runs the Remmo App.

The funds are collected at a central point and the person who opened the page can withdraw using mobile money or through a bank account.

“We have partnerships with mobile operators who facilitate people to pay using mobile money (M-Pesa, Airtel Money, Tigo Pesa etc) or they can pay using USSD or directly through the App from wherever they are. The money goes to our collections bank account and the person can withdraw it any time,” he adds.

Magambo says this platform is aimed at simplifying pledges and their fulfillment because sometimes people fail to contribute to social ceremonies just because they can’t make it to physical meetings.

The platform is still new on the market, having been launched at the end of 2021, but Magambo is optimistic people will adopt it with ease because of its advantages. Remmo removes the costs of soft copy-printing, distribution and validation of invitation cards; it eases management of pledges and contribution data and helps in time management by hosting virtual meetings.

Remmo is a women-centric product given that women are more involved in the preparation of social ceremonies than men.

Magambo meanwhile says one of the biggest challenges they have faced is the reluctance of big FinTech players such as banks and telecoms to avail their API infrastructure to FinTech startups.

He is however very grateful to the 40 Days 40 FinTechs platform for reaching out to emerging FinTechs across East Africa to showcase their unique stories.

The 40 Days 40 FinTechs initiative is organized by HiPipo in partnership with Level One Project, Mojaloop, ModusBox, and Crosslake Technologies with generous support from the Bill and Melinda Gates Foundation.

“This platform is good for FinTechs especially startups. It gives us the channel to air our creativity,” Magambo says.

Based in Tanzania, Remmo is the 46th participant in the third edition of #40Days40FinTechs initiative that has quickly grown into one of the world’s premier showcase events for the innovations that are enabling more people to join the digital economy space.

This year’s edition targets Digital Innovators and FinTechs around East Africa. The 40 Days 40 FinTechs initiative offers participants useful tools and an introduction to the industry’s emerging technologies, such as Mojaloop Open Source Software, and guidance from Level One Project foundational material. The skills gained from this initiative cover Level One Project Principles, Instant and Inclusive Payment Systems (IIPS), Inclusive Finance and FinTech in general.

According to HiPipo CEO Innocent Kawooya, this year’s edition looks at cementing achievements of the previous editions – where over 60 FinTechs have been transformed – but also build on them to leverage digital financial inclusion in East Africa and beyond.

“As HiPipo, our extensive effort and advocacy is partly for the intention of championing digital innovation and interoperable instant and inclusive payment systems (IIPS) in Africa to a point where our innovators enjoy and achieve sound profit margins to help them keep designing and deploying affordable and inclusive financial services for the poor,” Kawooya said.