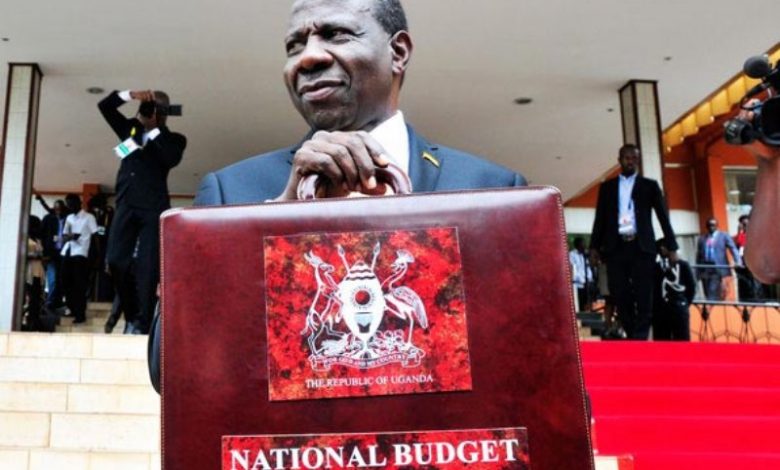

Tax waivers spark alarm amidst Shs72T national budget

This request comes on the heels of a recent report revealing that Uganda has already lost over Shs12 trillion in the past five years, due to similar tax exemptions raising red flags among economic experts.

As Uganda’s government requests parliament to exempt eight companies and individuals from paying taxes amounting to Shs13.391 billion, concerns are mounting over the broader impact of such tax waivers on the nation’s economy.

Government cites the lingering effects of the COVID-19 pandemic and ill health, as the reasons behind these tax waivers on the 8 companies.

This request comes on the heels of a recent report revealing that Uganda has already lost over Shs12 trillion in the past five years, due to similar tax exemptions raising red flags among economic experts.

Dr. James Mubiru, a renowned economist, has voiced his concerns over the government’s latest move.

According to Dr. Mubiru, these tax waivers could exacerbate Uganda’s financial instability, especially in light of the recently approved National Budget for FY 2024/25, which stands at a staggering Shs72 trillion.

“The government’s justification for these tax exemptions citing the pandemic and health-related issues is understandable, but it’s a slippery slope,” Dr. Mubiru argues.

“We’re talking about a nation that has already lost trillions in revenue through similar waivers. With a budget as massive as Shs72 trillion, every shilling counts. These exemptions, while beneficial to a few, could significantly undermine our ability to fund essential public services.”

Dr. Mubiru points out that the Shs13.391 billion in potential lost revenue could have been channeled into critical sectors such as healthcare, education, or infrastructure, particularly at a time when the country is grappling with rising costs and financial demands.

While the government emphasizes compassion in supporting businesses and individuals still reeling from the effects of the pandemic, Dr. Mubiru warns that such decisions should be weighed carefully against the long-term economic consequences.

“COVID-19 has undoubtedly affected many businesses, but we must also consider the precedent these waivers set,” he notes.

“Are we fostering a culture where large corporations can rely on exemptions rather than contributing their fair share to the national treasury? This could create a fiscal gap that’s hard to bridge, especially with such an ambitious budget.”

As parliament debates the proposed exemptions, the broader question remains: How can Uganda balance the need to support struggling businesses with the necessity of maintaining fiscal discipline?

Dr. Mubiru suggests a more targeted approach. “Instead of blanket exemptions, the government could explore tax relief programs that are conditional—perhaps tied to job creation or investments in specific sectors. This way, we ensure that the waivers benefit the economy at large and not just individual entities.”

Beyond the economic implications, Dr. Mubiru also stresses the importance of transparency in the process.

“The public has a right to know which companies and individuals are benefiting from these exemptions and why. In a country where tax compliance is already a challenge, opaque processes can erode public trust.”

As Uganda moves forward with its Shs72 trillion budget, the decisions made today regarding tax waivers will have lasting effects on the nation’s economic health.

Dr. Mubiru’s warning is clear: Without careful consideration and transparency, these exemptions could do more harm than good, risking the financial stability of a nation already facing significant economic challenges.

As parliament weighs the government’s request for tax waivers, the stakes couldn’t be higher. With a national budget that requires every possible source of revenue, Uganda must tread carefully to ensure that compassion for businesses doesn’t come at the cost of its economic future.