Here is how you can claim money from deceased individuals’ mobile money accounts

Section 57 of the Act established a specific seven-year timeframe during which individuals or entities can make claims to retrieve funds from the Bank of Uganda before they are transferred to the Consolidated Fund.

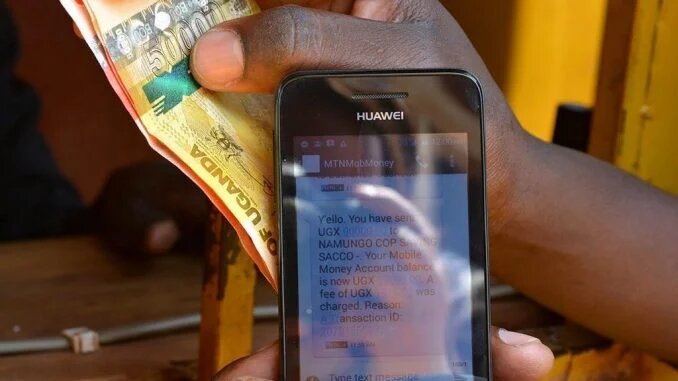

Bank of Uganda (BoU) recently told Parliament’s ICT Committee that it has Shs69bn of unclaimed funds from dormant accounts of several mobile money customers. The Central Bank also revealed that about Shs300M have been paid out to claimants, two years after it took over the regulation of mobile money platforms in Uganda.

Dormant accounts accrue for various reasons including the death of the account holder. In case of death, the Executive Director of Finance at Bank of Uganda, Richard Byarugaba, has explained the process of claiming money left on mobile money accounts of deceased persons.

National Payment System Act 2020

Prior to the implementation of the National Payment System Act 2020, dormant mobile money account funds were retained by the telecom operators, who were also responsible for handling claims. However, with the enactment of this Act, the Bank of Uganda has taken over this responsibility.

In the two years since its implementation, a total of Shs300 million has been disbursed to claimants from the Shs69 billion that was collected from telecom companies in dormant mobile money account funds.

According to Byarugaba, the introduction of the National Payments System Act 2020 brought significant improvements to this procedure.

Section 57 of the Act established a specific seven-year timeframe during which individuals or entities can make claims to retrieve funds from the Bank of Uganda before they are transferred to the Consolidated Fund.

How to claim

However, once this seven-year period has elapsed, any remaining claims can be directed to the Consolidated Fund, managed by the Ministry of Finance, Planning and Economic Development.

“After seven years, the money is given to the government and if anyone wants to claim this money, they go to the Ministry of Finance,” said Byarugaba. He urged the public to claim the money on mobile money accounts of deceased persons.

“You need to contact the service provider and report the claim with the deceased national identity card,” he explained.

Section 57 of the National Payments System Act 2020 outlines that an electronic money account that does not have a registered transaction for nine consecutive months shall be considered dormant. Telecoms are required in Section 57(2) to notify the customer at least one month before the elapse of the nine months.

However, if the claim is initiated after the funds have already been transferred to the Bank of Uganda; the claimant will need to visit the Bank of Uganda. Upon successful verification, the funds will be returned to Telecoms for subsequent payment to the claimant.

Increased use of mobile money

According to a performance report by telecom regulator Uganda Communications Commission (UCC) over the three months – January to March 2023 – registered mobile money accounts increased from 36.8 million to 37.3 million, reflecting a growth rate of more than 500,000 new accounts.

Regarding account activity, mobile money active accounts during the 90 days grew from 25.2 million in the previous quarter to 26 million in March 2023.

In addition, the agent footprint remained consistent, boasting a total count of 472,000 agents across the country, representing approximately 55 active wallets per agent.

In terms of year-on-year growth, an increase of 4 million new registered mobile money accounts was registered, reflecting a 12% growth since March 2022. Active new accounts (90 days) also increased substantially, with an additional 2.4 million new accounts, representing a 10% increase.

Spike in mobile money transactions

For mobile money transactions, UCC notes that in the three months ending March 2023, the industry recorded 1.44 billion mobile money transactions, up from 1.40 billion transactions at the end of December 2022.

This marks the first time the market has posted a positive net addition between the fourth quarter and the first quarter of the year. This growth is associated with a spike in transactions such as person-to-person (P2P) transfers, utility and merchant payments, gaming, and school fee payments.

In comparison to March 2022, the industry posted a net addition of 249 million transactions, from 1.2 billion transactions to 1.44 billion transactions in the quarter ending March 2023. This represents a 17% increase.