Time’s up for mobile money loan defaulters, telecoms tighten the noose

With the integration of telecom companies into the credit reference system, both banks and telecom providers will now have access to a centralized database, allowing them to identify blacklisted or grey-listed customers across networks.

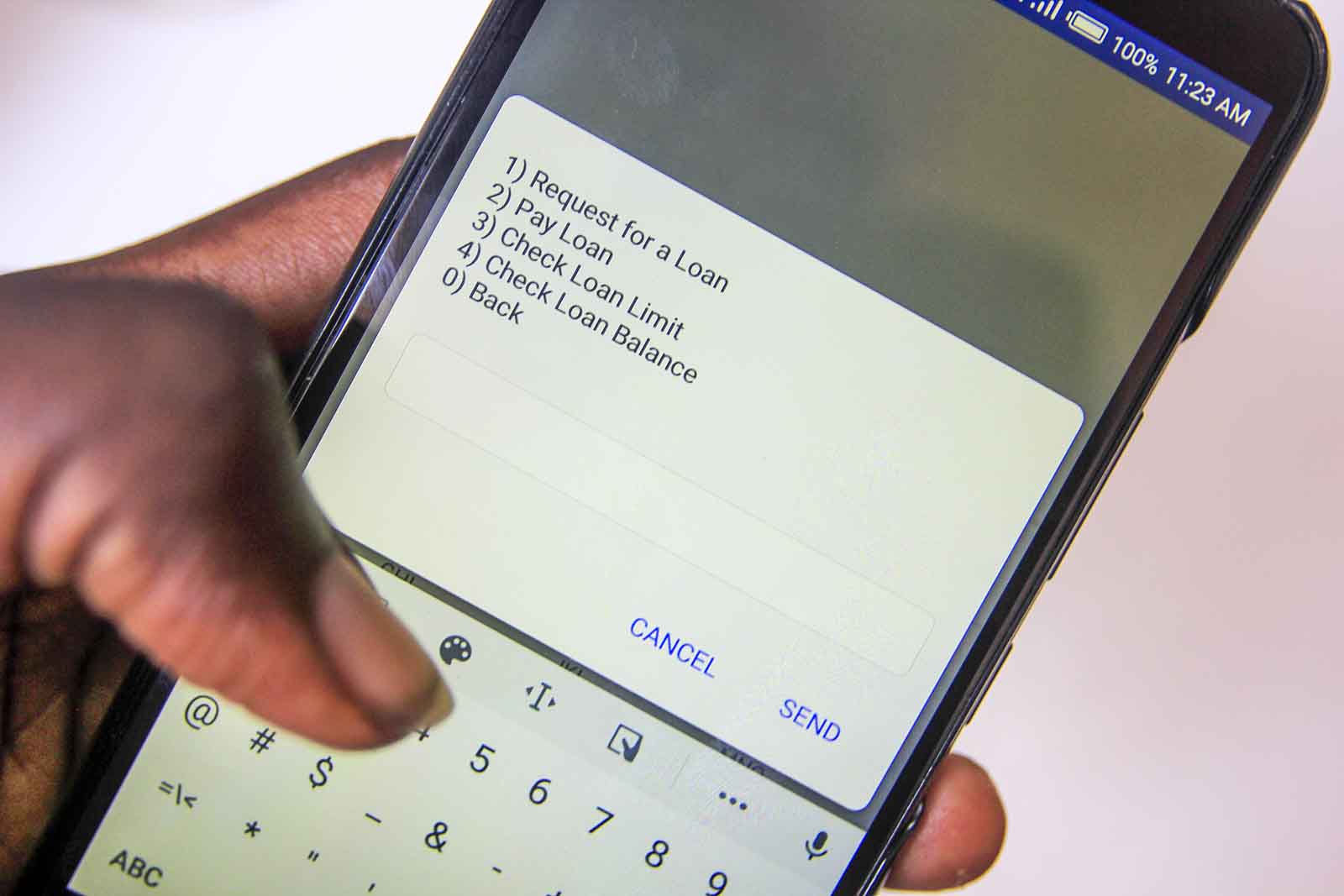

The world of digital lending is about to get tougher for loan defaulters in Uganda, as telecom companies prepare to crack down on those who fail to repay mobile money loans.

Richard Yego, CEO of MTN MOMO, recently revealed that telecom service providers are in the process of acquiring accredited credit provider certification to tackle the growing issue of defaulters, marking a significant shift in the way mobile money services operate.

Speaking at the launch of XtraCash, a new digital micro lending solution targeting MTN Mobile Money users, Yego explained how the system will allow credit service providers to access information on customers’ borrowing behavior, through a central credit reference bureau.

“We are working on getting accredited credit provider certification to crack down on defaulting customers. The certification requires that we pick your NIN even if you buy another Sim card or go to another network. We shall trace your NIN, and we will still be able to follow you up,” Yego said at the event, held at the headquarters of PostBank Uganda.

With the integration of telecom companies into the credit reference system, both banks and telecom providers will now have access to a centralized database, allowing them to identify blacklisted or grey-listed customers across networks.

This development has sparked mixed reactions among Kampala residents, some seeing it as necessary, while others worry about its potential impact on everyday borrowers.

Expert Opinion on the New System

Dr. Samuel Busuulwa, an economist and financial expert based in Kampala, believes the move is timely, given the rapid rise in digital lending services across the country.

“Uganda has seen a huge increase in the number of people taking short-term loans through mobile money platforms, and this has been convenient for many. But with convenience comes responsibility, and defaulting on these loans has become a problem. By introducing stricter regulations and sharing defaulters’ information across networks, telecom companies are sending a strong message that loans are not free money,” Busuulwa explains.

He adds that the system will create a more disciplined borrowing culture. “People need to understand that their credit history follows them, whether it’s with a bank or a telecom provider. Defaulting on a mobile loan could impact your ability to access bigger loans in the future.”

Public Reaction: A Mixed Bag

On the streets of Kampala, the reaction to telecoms tightening their grip on loan defaulters is varied. Sarah Nakaziba, a boutique owner in the city center, thinks the move will help reduce reckless borrowing.

“Some people borrow money from mobile loans without any plan to pay back. This new system will make people more responsible, especially if they know they can’t escape by just switching sim cards,” she says.

However, not everyone shares her optimism. Moses Waiswa, a boda boda rider who occasionally takes small loans through his mobile money account, is concerned about the consequences for low-income borrowers.

“Sometimes we take loans just to survive, especially during tough months. If I miss a payment because of a bad week, does that mean I can’t borrow again in the future? It feels like it will punish the poor more than anyone else,” he says.

The introduction of accredited credit provider certification by telecom companies is expected to reshape the digital lending landscape in Uganda. With both opportunities and challenges on the horizon, borrowers will need to be more cautious about their financial decisions as telecom companies begin cracking down on defaults.

For those with good credit behavior, the system could mean easier access to financial services, while defaulters may find themselves locked out of the very platforms they once relied on.

As Uganda’s digital lending ecosystem evolves, one thing is certain: the days of borrowing with no accountability are coming to an end.