Is BoU thriving, or just surviving?

In accordance with this Act, the minister of finance presents this report to parliament not later than three months after the end of each financial year.

By Mark Kidamba

As a statutory requirement stipulated in Section 49 of the Bank of Uganda Act 2000, the central bank is obliged to submit a balanced, transparent and complete account of its performance to the minister of finance.

In accordance with this Act, the minister of finance presents this report to parliament not later than three months after the end of each financial year.

Duly, the Bank of Uganda (BoU), fulfilled this obligation on 23 September 2024 when it authorized its 2023/24 annual financial report for issuance. The release of this report was highly anticipated because there had been a lot of uncertainty about the central bank running without a governor close to three years. The last Governor, Prof Emmanuel Tumusiime-Mutebile died in January 2022.

To its credit, the annual report gave detailed information about BoU’s financial, operational, environmental, social and governance performance for the year ended 30 June 2024. It also evaluated its performance based on its mandate of promoting price stability, and a sound financial system in supporting socio-economic transformation in Uganda.

The most noticeable features gleaned from the annual report are:

- Headline inflation averaged 3.2 percent, down from 8.8 percent the previous fiscal year.

- Import cover is 3.1 months, down from 3.8 months in June 2023. This means that the reserves BoU holds can cover up to 3.1 months of exports. A severe depletion of import cover leads to an economic crisis like the one India experienced in 1991 after registering two weeks of import cover. A reduction on import cover, directly devalues the shilling.

- Total BoU assets dropped by 3 percent to UGX 26 trillion [$ 7.1 billion] from UGX 27 trillion [$ 7.3 billion] in June 2023. The assets include: government bonds, loans to banks, gold, and private debt. This loss was attributed to net outflows of forex on government imports and services, and on repayment of external debt.

- Foreign reserves were $3.2 billion, down from $ 4.07 billion in June 2023. This shows a reduction in inflow of foreign institutional investments into the economy.

- The Central Bank Rate [CBR] went up to 10.25 percent from 10 percent in June 2023 signalling a rise in interest rates.

- In FY 2023/2024, Uganda recorded an overall balance of payments deficit position of $ 1.1 billion. In FY 2022/23, the balance of payments deficit was $ 50.4 million. This deterioration was largely attributed to an 8.2 percent increase in the current account deficit to $ 4.1 billion. A balance of payments deficit is simply an excess of payments over income/revenue. It means that Uganda imported more goods, services, and money than it exported and this translates to economic imbalance, low production, and low investment in the country.

- The financial account surplus declined by 23.7 percent to $ 2.6 billion in FY 2023/24 from $ 3.3 billion the previous year. This reduction in the financial account surplus was attributed to lower loan disbursements, higher principal repayments and portfolio outflows. The dip in the financial account surplus symbolises a drop in foreign investment in Uganda; also, it signals that Uganda isn’t investing enough in foreign assets like bonds and equities.

- BoU’s net worth increased by 35.2 percent to UGX 5.4 trillion [$ 1.4 billion] from UGX 4 trillion [$ 1,096 million] at the end of June 2023.

- The central bank’s comprehensive income for the year ended 30 June 2024 was UGX 1.2 trillion [$ 328.8 million] compared to UGX 277.7 billion [$ 76.1 million] on 30 June 2023.

- Income from foreign assets investments totalled to UGX 805.8 billion [$ 220.8 million] in FY 2023/24 up from UGX 438.6 billion [$ 120.1 million] in FY 2022/23.

The crux of the report however lies in the statistics: the currency in circulation increased by 12 percent [BoU annual report 2023/24, p.56] from UGX 7.3 trillion [$ 2 billion] to UGX 8.2 trillion [$ 2.2 billion]. These include bank notes and coins. The fundamentals of monetary economics – quantity theory of money, dictate that the rate of inflation in an economy is equal to the amount of money that has been injected into it.

Therefore, if currency circulation in Uganda increased by 12 percent in the FY 2023/24, inflation would rise by the same rate, and not below 5 percent.

An increase in currency circulation would put more money into the economy — inflation, which would later devalue the shilling. It’s vital to keep in mind that it takes a while for the effects of the injected money to kick in, and for it to be drained out when interest rates are raised.

Another source of concern is the reduction in its total assets by UGX 818 billion [$ 224.1 million] in the year ended 30 June 2024. The reduction of the central bank’s assets impacts its status and authority. Persistent losses could lead BoU into inconsistent use of monetary policy.

A reduction in a central bank’s assets is usually accompanied by increases in interest rates which eventually lead to a reduction in profitability, investment and growth in an economy.

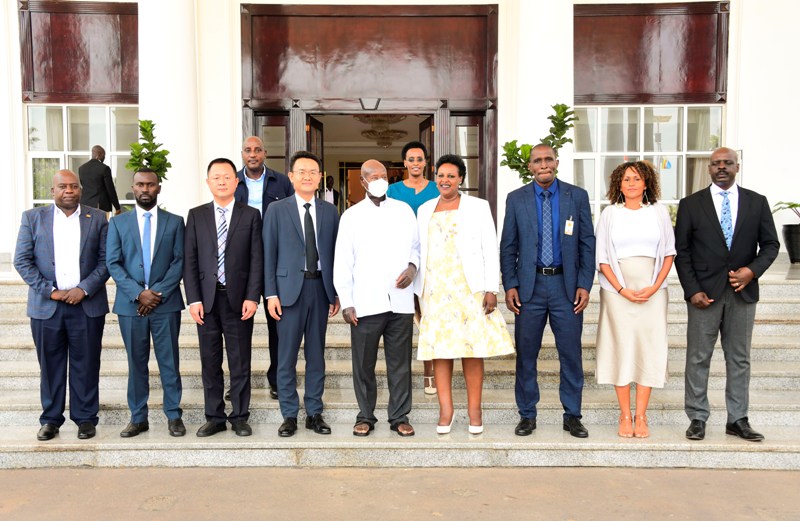

This author was privileged to get audience with] BoU’s Deputy Governor, Dr. Micheal Atingi-Ego to seek his insight on matters concerning the mismatch between the increase of money supply in the Ugandan economy, and documented inflation; along with the waning assets of BoU. This is what he had to say:

“The growth in money supply is not inherently inflationary unless it significantly outpaces economic growth. In other words, a demand-pull inflation occurs when there is too much money chasing too few goods. In FY 2023/24, Uganda’s money supply (M3) grew by an average of 9.8%, which was in line with the nominal GDP growth of approximately 10.5%. Consequently, the impact of Uganda’s money supply on inflation during this period was not extraordinary, as it was commensurate with the economy’s growth rate (real GDP growth and the inflation objective)”.

On the shrinking assets of the central bank, and how BoU plans to bounce back from the plunge; the former Deputy Director at the African Department at the IMF explained, “The decline in foreign exchange reserve assets partly explains the drop in BoU assets and did not interfere with monetary policy or lead to inflationary pressures. The global environment was not conducive to warrant the necessary purchase of US dollars for reserve build-up in FY 2023/24.

“However, with the stabilization of the global economy, BoU has taken steps to re-build foreign exchange reserves. Since the start of FY 2024/25, the central bank has purchased foreign exchange from commercial banks in addition to utilizing foreign exchange swaps/cross currency repos. The Bank also plans to diversify its reserve assets by purchasing gold in its efforts to rebuild reserves”.

Another point of interest is that BoU needs to balance its unmatched human resources. Although the bank has got 921 staff, only three have IT programming skills, and four with investment skills. This is a drop in the ocean since the bank has to be alert and protect itself from cyber security risks and risks of system failure.

The four investment staff cannot satisfactorily manage BoU’s sophisticated investment portfolio which comprises: derivatives, bonds, equities, gold, and other money market instruments. At the same time, the bank should invest funds appropriated to the Petroleum Revenue Investment Reserve [PRIR]; as they carry out their duty of providing advisory technical support to Petroleum Authority Uganda [PAU], Uganda National Oil Company [UNOC], and the extractive sector in Uganda at large.

BoU is run by a board of directors with seven members, nine committees, fifteen sub-committees, eleven executive directors, and twenty-seven directors. In the last financial year, the non-executive directors were each paid UGX 7,142,867 [$ 1,957] per month as gross retainer, and UGX 3,571,429 [$ 978] per meeting as sitting allowance.

Up to twenty-six meetings were attended in the last financial year alone. When juxtaposed with the US Federal Reserve that oversees a federation of fifty states in the world’s biggest economy, yet, it is governed by a board of seven members and eight committees comprising twenty-six members. In that case, it’s not unrealistic to assume that BoU’s administration is overcrowded.

Mark Kidamba