EAC securities regulators forge path for integrated, sustainable markets in Kampala meeting

EASRA serves as a crucial consultative institutional forum where regulatory authorities discuss matters of mutual interest affecting their operations.

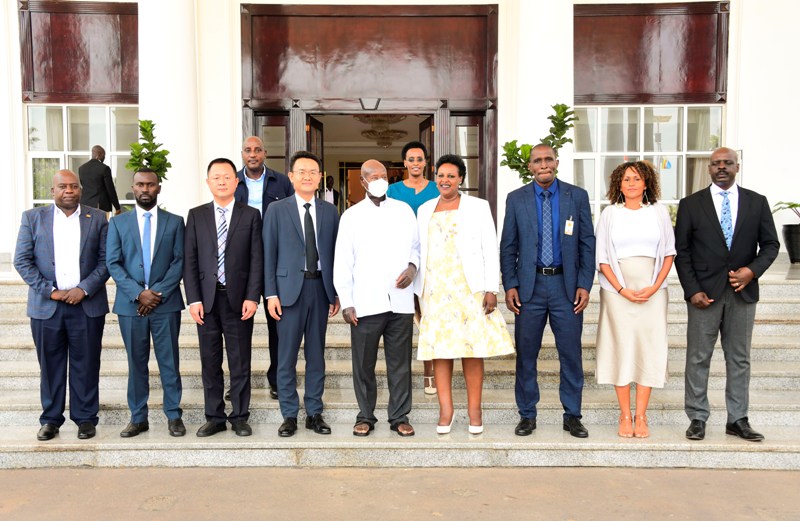

The East African Securities Regulators Association (EASRA) recently concluded a pivotal meeting in Kampala, hosted by Uganda’s Capital Markets Authority (CMA). The high-level gathering brought together top financial regulators from across the region to reinforce their commitment to fostering a more integrated, inclusive, and resilient capital market within East Africa.

The meeting saw the participation of key figures from the region’s capital markets authorities. Notable attendees included Ms. Josephine Okui Ossiya, Chief Executive Officer of CMA Uganda, Mr. Wyckliffe Shamiah, Chief Executive Officer of CMA Kenya, Mr. Nicodemus Mkama, Chief Executive Officer of Tanzania’s Capital Markets and Securities Authority (CMSA), Mr. Thapelo Tsheole, Chief Executive Officer of Capital Market Authority (CMA) Rwanda, and Dr. Arsène Mugenzi, Chief Executive Officer of Capital Market Authority (CMA) Burundi, among other senior representatives.

EASRA serves as a crucial consultative institutional forum where regulatory authorities discuss matters of mutual interest affecting their operations. The Association’s core objectives, which underpinned the Kampala discussions, include robust information sharing among members, fostering mutual assistance and cooperation, and crucially, advancing the integration of the East African capital markets.

The Kampala meeting yielded several significant agreements aimed at shaping the future trajectory of the region’s financial landscape. Key outcomes included:

Harmonisation of ESG Standards: A landmark agreement was reached to harmonize Environmental, Social, and Governance (ESG) standards across member states, signaling a united front towards sustainable finance.

Improved Data Quality for Sustainable Finance: There was a strong commitment to enhancing data quality, a vital component for building robust sustainable finance frameworks.

Enhanced Access to Private Capital for SMEs: Strategies were devised to improve access to private capital, particularly for Small and Medium-sized Enterprises (SMEs), recognizing their role as engines of economic growth.

Renewed Focus on Cross-Border Investment: Regulators reaffirmed their focus on boosting cross-border investment by aligning regulatory frameworks, thereby easing the flow of capital across borders.

Strengthened Cooperation for Inclusive Market Development: The meeting underscored a renewed dedication to strengthened cooperation to support inclusive market development, ensuring that capital markets benefit all segments of society.

These collaborative efforts by EASRA members underscore a vital step in transforming East Africa’s capital markets. As global and regional financial ecosystems continue to evolve, the shared commitments made in Kampala are poised to drive sustainable growth and foster a more robust financial future for the entire East African community.