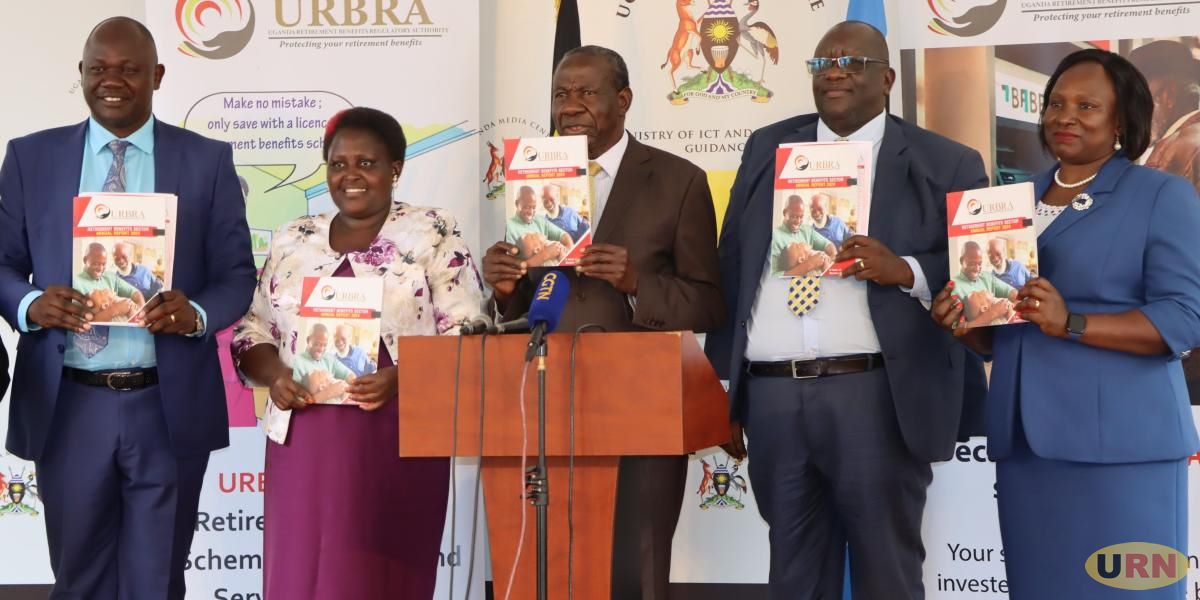

How Uganda’s retirement benefits sector hit UGX 25.4 trillion, boosting GDP to 12.2%

The sector's growth was fueled by a net income of UGX 3.10 trillion and net member contributions amounting to UGX 989.94 billion.

Uganda’s retirement benefits sector has achieved remarkable growth, with its total value rising to UGX 25.40 trillion in 2024 an 18.6% increase from UGX 21.4 trillion in 2023.

This expansion has elevated the sector’s contribution to the national GDP to 12.2%, up from 10% in the previous year, according to the Uganda Retirement Benefits Regulatory Authority (URBRA).

Key Drivers of Growth

The sector’s growth was fueled by a net income of UGX 3.10 trillion and net member contributions amounting to UGX 989.94 billion. Income from fixed-income securities contributed over 90% of the total revenue, enabling retirement schemes to declare an impressive average interest rate of 10.99%.

“The growth of the retirement benefits sector reflects the increasing awareness among Ugandans about the importance of saving for retirement,” noted Ritah Nansasi Wasswa, URBRA’s Acting CEO.

Finance Minister Matia Kasaija attributed the positive performance to a combination of robust net income and growing member contributions.

Membership in retirement schemes increased by 7% to 3.37 million accounts in 2024, while contributions grew by 8.3% to UGX 2.39 trillion. The surge was driven by enhanced employer compliance, salary increments, and new registrations.

In a bid to widen retirement savings coverage, URBRA launched the National Long-Term Savings Scheme (NLTSS) targeting informal workers. Currently, only 15% of Uganda’s workforce is covered by retirement savings, but the NLTSS aims to bridge this gap.

“The NLTSS is a transformative initiative that will empower informal workers to secure their financial futures,” said Julius Junjura Bigirwa, URBRA’s Board Chairman.

URBRA’s risk-based supervision system recovered UGX 23.3 billion for members in 2024, reinforcing transparency and risk management within the sector.

“This achievement underscores our commitment to safeguarding members’ interests and promoting a transparent retirement benefits system,” said Wasswa.

Future Outlook

With increasing awareness and demand for retirement savings products, Uganda’s retirement benefits sector is poised for continued growth. The combination of strategic initiatives like the NLTSS and robust regulatory oversight is expected to secure the financial well-being of millions of Ugandans.