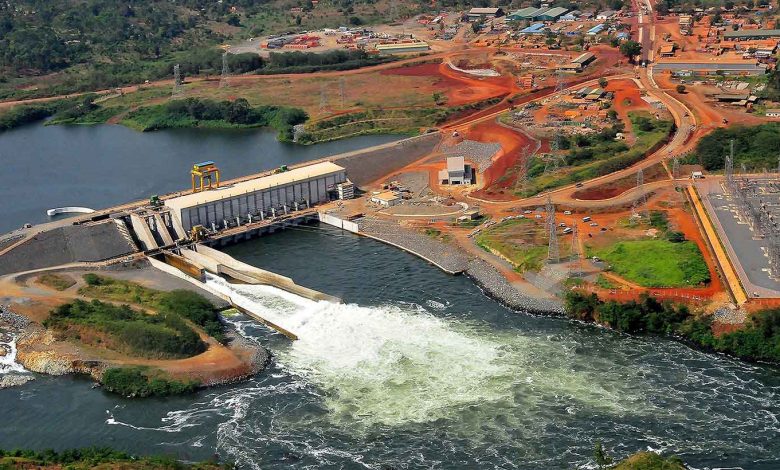

MPs reject govt’s proposal to exempt Bujagali from income tax

The Leader of the Opposition, Hon. Joel Ssenyonyi underscored the danger of granting Bujagali another exemption without the Auditor General’s report, saying that such a decision would not be well informed.

A proposal by government to exempt the Bujagali Hydro Power project from income tax has been rejected by lawmakers who instead demanded for a report of the Auditor General on the project.

The decision was reached at during the plenary sitting on Monday, 06 June 2024 as the House considered the Income Tax (Amendment) Bill, 2024.

Speaker Anita Among who presided over the meeting read a letter from the Minister of Finance, Planning and Economic Development, Hon. Matia Kasaijja seeking an insertion of a clause in the Bill to give Bujagali Hydro Power a one-year income tax exemption up to 30 June 2025.

“The rationale of this proposal is to avoid escalation of the end user tariff since tax is part of the formula for computing the tariff as we await the report from the Auditor General,” read the letter.

This proposal was however, rejected at committee stage, where there was a general consensus from Members of Parliament (MPs) who tasked the minister to give a timeframe within which the Auditor General’s report would be presented.

Hon. Abdu Katuntu (Indep., Bugweri County) said that whereas Parliament commissioned the Auditor General to perform an audit of Bujagali, MPs do not know the status of the audit.

“We may pass this Bill without this request and they [ministers] come back with amendments and we discuss in detail other than passing something we are not sure of,” said Katuntu.

He pointed out that government has foregone up to Shs380 billion in revenue since 2012 when the tax waivers started.

Pakwach District Woman MP, Hon. Jane Pacuto raised concern over the recurrent requests to exempt the power generator from income tax without a report from the Auditor General.

“The public is looking at us as playing games every year; there are extensions with the excuse that tariffs will go high,” said Avur.

The Leader of the Opposition, Hon. Joel Ssenyonyi underscored the danger of granting Bujagali another exemption without the Auditor General’s report, saying that such a decision would not be well informed.

“If an audit is available and it makes economic sense, we go ahead and give the exemption but right now we are operating in the dark,” said Ssenyonyi.

Hon. Patrick Oshabe (NUP, Kasanda County North) wondered why government continues to grant the power project tax exemptions, despite making profits.

“Tax exemptions for Bujagali started in 2012 and they were supposed to end in 2017 but extensions still went on, with the saying that tariffs were going to reduce and yet they instead increased. Why is Bujagali always on the list of exemptions,” Oshabe asked.

The Minister of State for Finance, Hon. Henry Musasizi committed that he will expeditiously handle the processing of the Auditor General’s report, saying that it will be ready in six months.

“We must make a decision based on the audit but the audit has delayed. Immediately after this budget process, I will undertake to pursue the Auditor General’s report,” Musasizi said.

Speaker Among then guided that the minister re-introduces the proposal through an amendment.

MPs also rejected a proposal that sought to expand capital gains tax to include the sale of land in cities and municipalities, and rental property.

While presenting the report of the Committee of Finance, the Chairperson, Hon. Amos Kankunda said that the taxation of capital gains is already catered for under Section 21 of the lncome Tax Act.

“The committee observed that the proposal for the expansion of the scope of capital gains tax to include land in cities and municipalities does not fall within the principles of vertical or horizontal equity in taxation and as such should not stand part of the Bill,” read the report in part.

On the other hand, the MPs approved income tax exemption for specialised hospitals with the committee justifying that the aim is to attract investment in the provision of specialised medical services.

“The proposal has the potential to promote the development of specialised services in Uganda which will reduce medical tourism and support tourism in Uganda from patients coming from neighbouring countries,” Konkunda said.

In his minority report, Hon. Ibrahim Ssemujju Nganda (FDC, Kira Municipality) however, questioned the motive behind exempting specialised hospitals saying that the list of the benefiting hospitals was not availed.

“Can government table a list of who qualifies for these incentives before consideration of this Bill,” said Ssemujju Nganda.