Why saver’s reduced withdrawals suggest growing confidence in NSSF

NSSF Managing Director Patrick Ayota highlighted that trust in the Fund’s ability to secure and grow savings has led to a reduction in benefit payouts, which decreased from UGX 1.199 trillion to UGX 1.120 trillion.

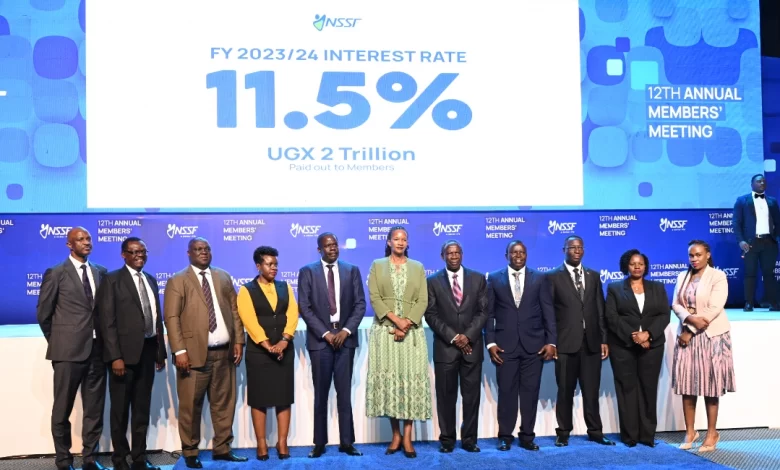

Savers with the National Social Security Fund (NSSF) are set to receive an 11.5% interest rate for the Financial Year 2023/24, a significant increase from last year’s 10%.

This announcement, made by Finance Minister Hon. Matia Kasaija, will see UGX 2 trillion credited to member accounts, reflecting the Fund’s commitment to preserving and growing members’ savings.

“The interest rate I have declared is above the 10-year average rate of inflation, ensuring the value of members’ savings continues to grow,” the Minister said.

This boost comes amid a notable shift in saver behavior, with fewer members withdrawing their funds. NSSF Managing Director Patrick Ayota highlighted that trust in the Fund’s ability to secure and grow savings has led to a reduction in benefit payouts, which decreased from UGX 1.199 trillion to UGX 1.120 trillion.

“People who qualify to withdraw their savings are opting not to because they trust the Fund to not only ensure safety but also growth in the value of their money,” Ayota explained.

This confidence is further bolstered by the Fund’s impressive growth in assets, which now stand at UGX 22.13 trillion, maintaining its position as East Africa’s largest fund by value.

Member contributions also increased by 12.2%, reaching UGX 1.93 trillion for the financial year 2023/2024.

Minister of State for Labour, Employment, and Industrial Relations, Hon. Davinia Esther Anyakun, also weighed in, noting the importance of expanding social security coverage. She revealed that consultations with workers to develop regulations for voluntary products have been completed.

“We have finalized the consultative process to structure regulations for new voluntary products. I will endorse and publish them soon,” Anyakun said, emphasizing the government’s commitment to broader social security inclusion.

The NSSF’s long-term vision, dubbed Vision 2035, aims to grow the Fund to UGX 50 trillion and extend social security coverage to 50% of Uganda’s working population by 2035. With more members opting to keep their funds invested, NSSF is positioning itself as a key pillar in securing Uganda’s financial future.