How to Identify a Ponzi scheme: Insights from Bank of Uganda

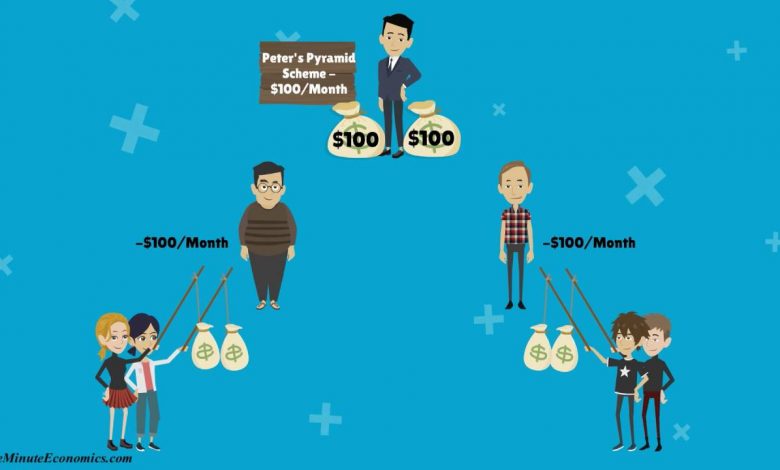

A Ponzi scheme is a fraudulent investment scheme that promises high returns with little or no risk to investors. The scheme generates returns for earlier investors by acquiring new investors. Instead of profits coming from legitimate business activities, the returns are paid using the capital from newer investors.

In the modern era, where financial investments and opportunities abound, it’s crucial for individuals to be well-informed and vigilant against potential scams. One particularly dangerous scam that has affected unsuspecting investors is the Ponzi scheme.

A Ponzi scheme is a fraudulent investment scheme that promises high returns with little or no risk to investors. The scheme generates returns for earlier investors by acquiring new investors. Instead of profits coming from legitimate business activities, the returns are paid using the capital from newer investors. Eventually, the scheme collapses when it becomes impossible to recruit new investors to pay the promised returns.

In recent years, Uganda has seen a rise in financial scams that prey on unsuspecting investors: Ponzi schemes. These fraudulent investment schemes promise high returns with little risk, enticing people with the prospect of quick and easy money. However, these schemes are built on deception and ultimately lead to financial ruin for those involved.

A more recent case involved a company known as Capital Chicken; an agribusiness contract farming partnership enterprise who rear poultry on behalf of individuals who wish to earn an income out of poultry farming.

According to the Deputy Spokesperson Kampala Metropolitan Police ASP Luke Owoyesigyire, It is alleged that between the years 2021 and 2023, Capital Chicken operated an office along Kanjokya Street in Kampala Central Division, where individuals entrusted their money for investment, with the promise of returns.

“Initially, this operation appeared to run smoothly, but recently, concerns arose as some members encountered unusual behavior from the management. Reports indicated that members were being asked to “come back later” when visiting the office for transactions. On September 29, 2023, the situation escalated when individuals arrived at the office to find it unexpectedly closed. In light of these developments, concerned citizens promptly reported the matter to the police,” he explained.

Owoyesigyire revealed that the company scammed 41 victims with transactions totaling approximately 1,641,376,000 Ugandan Shillings.

However in a statement released by Capital Chicken, they alleged that they were temporarily closed by the Capital Markets Authority (CMA) and the subsequent freeze of their accounts by the Financial Intelligence Authority (FIA) which made it impossible for them to run normal operations.

“We call upon our farming partners to be calm as we navigate the turbulence created by the various agencies who should have instead engaged us on regulatory issues if indeed, the intention was to streamline our operations,” reads an excerpt from the company.

In response, CMA refuted claims saying that Capital Chicken is not authorized to offer investments contracts to the public.

“The CMA has not temporarily closed Capital Chicken as alleged. This matter is now being handled by the Uganda Police Criminal Investigations Directorate.”

Bank of Uganda’s Role

Bank of Uganda, as the country’s central bank, is committed to ensuring the stability and integrity of the financial sector. They provide valuable information to the public to help them recognize the signs of Ponzi schemes and protect their hard-earned money. Here are some key indicators to watch out for:

- The investment guarantees high returns with little risk of losing your investments. A good general rule to follow is It sounds too good to be true.

- Promises consistent returns despite market conditions. Legitimate businesses usually experience times of loss and profit.

- The investment strategies or business activities are described as too complex for the investor to understand or top secret. If the business cannot be explained, then it is a scam.

- The company or proprietor focuses on getting new clients or investors. Without a consistent flow of investments to provide returns to investors, the scheme falls apart.

- Both old and new investors face difficulties removing their money from the scheme.