KACITA begs for URA lenience

KACITA Uganda has asked URA to find a solution to inconsistent tax assessments and tax records which distort the relationship between taxpayers and the tax body.

Kampala City Traders Association (KACITA) Uganda has asked Uganda Revenue Authority (URA) to find a solution to inconsistent tax assessments and tax records which distort the relationship between taxpayers and the tax body.

The traders have also asked URA to prevail on their tax officers who misbehave while visiting their businesses.

These sentiments were expressed by the traders’ leaders at a joint press conference held by KACITA and URA in Kampala on Friday.

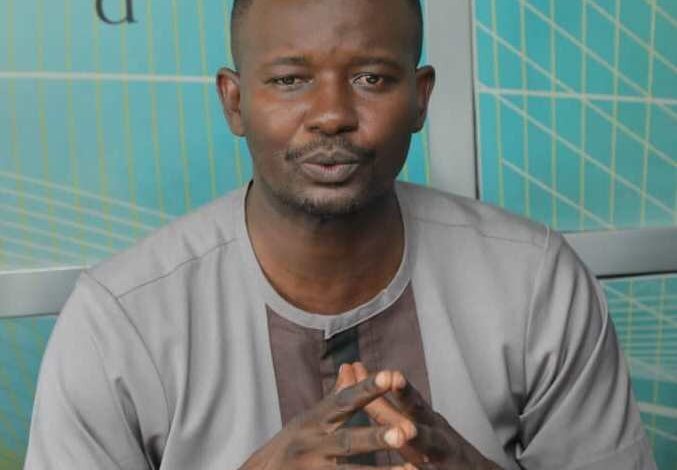

Thaddeus Naggenda, the Chairperson of KACITA, noted that for all challenges like these to be solved, URA has to carry out adequate tax education engagements with business owners.

“We observed that lately, some business premises, particularly shops, have been closed off by URA enforcement officers due to uncleared rental tax obligations by landlords which is detrimental to tenants detriment, ” he reiterated.

However, Naggenda further explained that KACITA has signed an MOU with URA which highlights how traders’ concerns shall be handled.

The MOU also provides a platform and a special taxation desk at the KACITA secretariat to guide and support the members on tax issues.

KACITA and URA also initiated sectoral engagements since it was recognized that taxation concerns differ according to various business sectors.

This is done in coordination with sectoral leaders and their structured committees.

According to Ibrahim Bbossa, the acting Public and Corporate Affairs Officer at URA, through this strong partnership, KACITA advocated for extra revenue coordinating offices in the city centre.

He said that URA duly responded by establishing a fully functional office at Kampala Boulevard where all tax-related matters within the Central Business District are easily handled.

This same week, UR) pledged to reduce their actions that make taxpayers uncomfortable such as issuing agency notices and locking up the premises of tax defaulters.

The tax body said that doing so, it doesn’t imply that they have deviated from the law and their mandate but to use these alternatives only when they must.